Silver is experiencing one of the strongest rallies in decades. Year-to-date gains are approaching 100% as of mid-2026, catching even the most optimistic analysts off guard.

This performance has transformed the conversation from “will silver break $50?” to “could we actually see $100?”

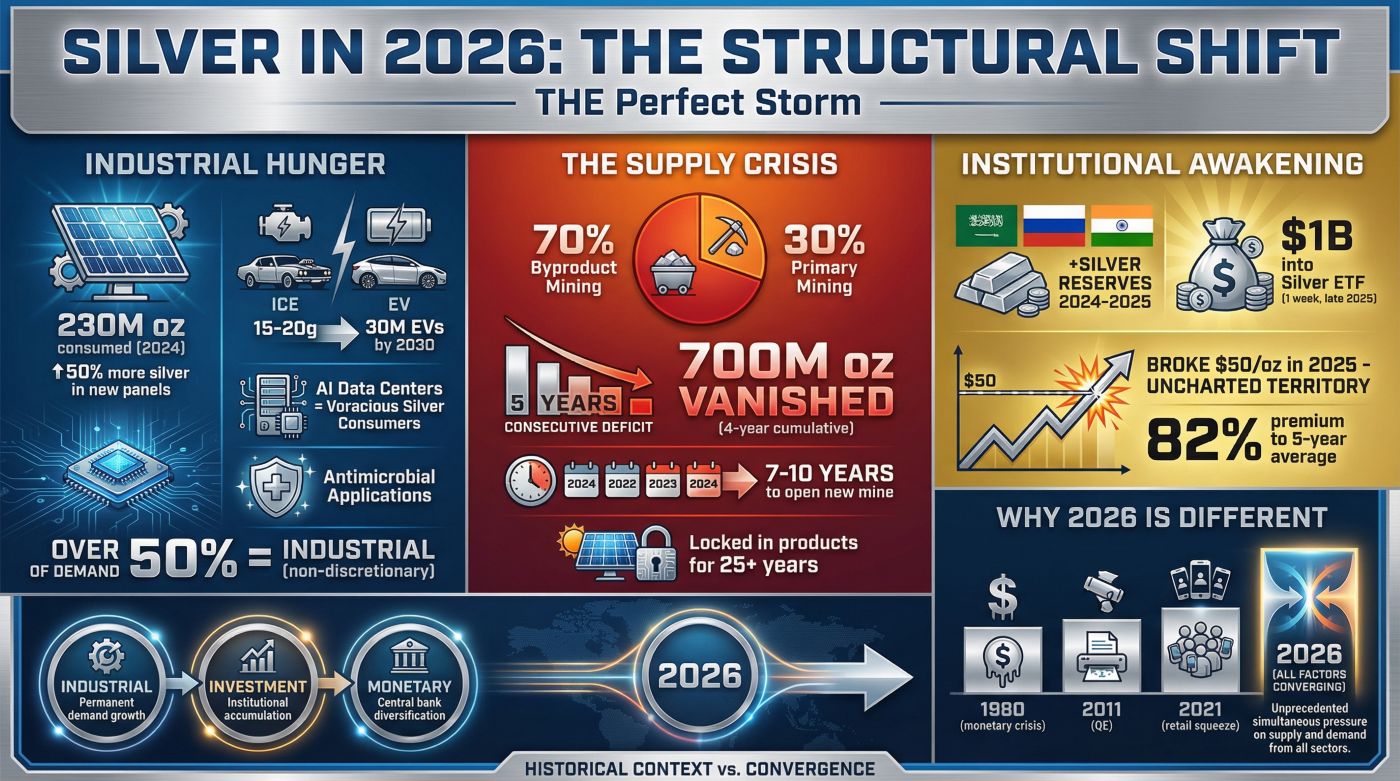

The metal’s character has fundamentally shifted. Industrial applications now represent roughly 60% of total demand, changing silver from primarily a precious metal into a critical industrial commodity. Solar panels alone consumed about 140 million ounces in 2023, with projections showing that number doubling within five years as renewable energy mandates speed up globally.

The supply-demand equation has entered its fifth consecutive year of structural deficit. Mine production plus recycling cannot meet industrial and investment demand simultaneously.

Unlike previous commodity booms where high prices quickly brought new supply online, silver mining capacity cannot expand rapidly because roughly 70% of silver comes as a byproduct of copper, lead, and zinc mining.

You can’t just “mine more silver” without economic incentives aligning across multiple metal markets simultaneously.

China and India together account for over 40% of global silver demand, making their economic trajectories critical to price forecasts. Most Western analysts focus primarily on US dollar strength and Federal Reserve policy, potentially missing bigger structural shifts happening in emerging markets where the middle class is expanding and industrial consumption is accelerating.

The silver-to-gold ratio, which measures how many ounces of silver equal one ounce of gold, recently touched levels not seen since the 1980s silver spike. Historically, when this ratio reaches extremes, mean reversion tends to follow.

Gold falls, silver rises, or both move in opposite directions until the relationship normalizes.

The current ratio suggests silver may have considerably more room to run relative to gold, even if both metals stay in bullish territory.

The silver market right now sits at a fascinating crossroads where mainstream analysts are comfortable with $50-65 targets while a vocal minority is seriously discussing triple-digit prices. Both camps have compelling arguments.

Understanding the Current Price Dynamics

The path silver has taken to reach current levels around $60 tells you almost everything you need to know about whether $100 is realistic. Bank of America, UBS, Citigroup, and Goldman Sachs have all raised their forecasts substantially over the past six months.

These institutions employ teams of analysts who build sophisticated models accounting for dozens of variables.

When they collectively move their targets upward, something material has changed in their assessment of underlying fundamentals.

Three things converged simultaneously that rarely align so perfectly. First, the US dollar began a sustained weakening trend as markets priced in Federal Reserve rate cuts and growing concerns about US fiscal sustainability.

Since commodities are dollar-denominated, a weaker dollar mechanically makes them cheaper for foreign buyers and more attractive as dollar-alternative stores of value.

Second, interest rates started declining from multi-decade highs, reducing the opportunity cost of holding non-yielding assets like precious metals. When you can get 5% risk-free in Treasury bills, silver has to compete with that.

When rates drop to 3%, suddenly silver’s appeal increases considerably.

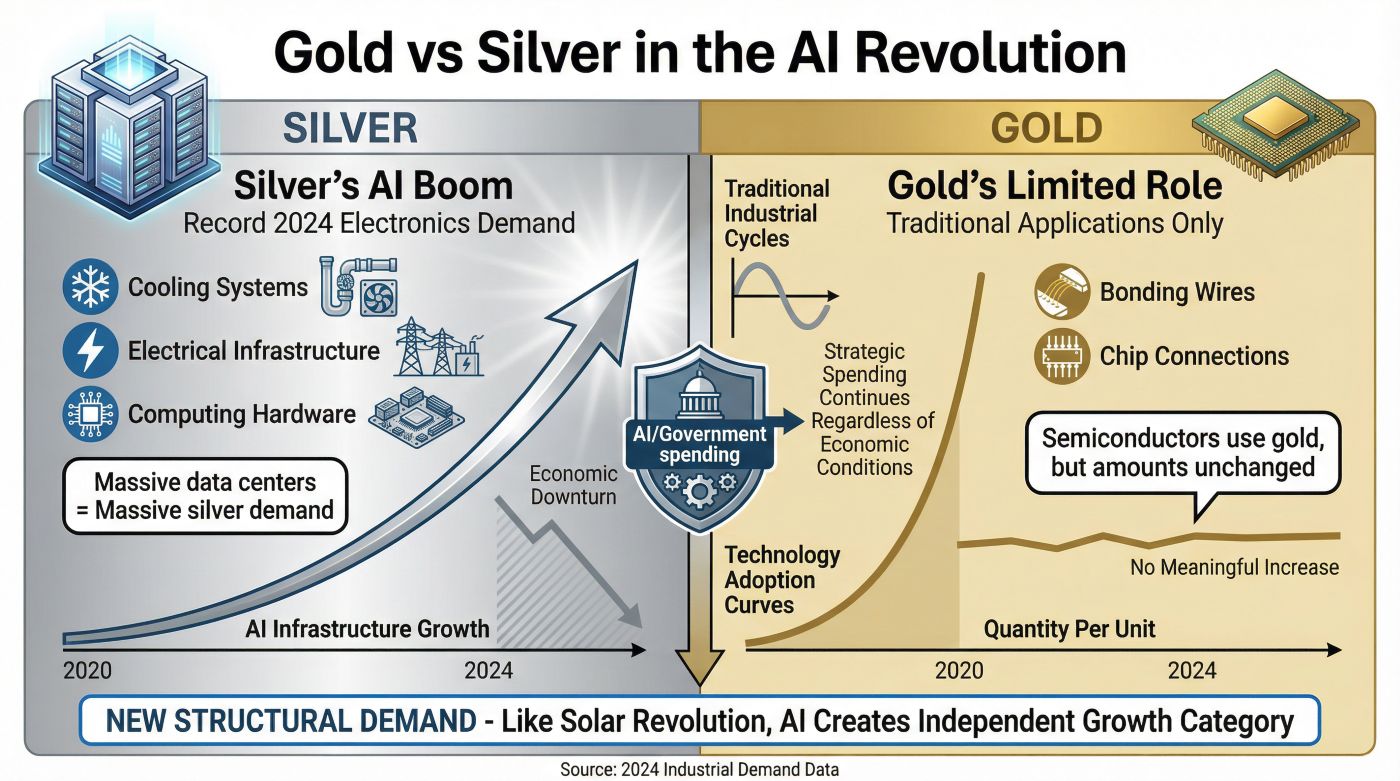

Third, and perhaps most importantly, industrial demand projections got revised upward across multiple sectors simultaneously. Solar, electronics, medical applications, and even emerging technologies like 5G infrastructure and quantum computing components all showed accelerating silver requirements.

The challenge with forecasting any commodity price means predicting the intersection of supply and demand at a future point in time, but both variables are influenced by the price itself. Higher silver prices incentivize more mining exploration and recycling while simultaneously discouraging marginal industrial uses.

Lower prices do the opposite.

Finding equilibrium needs identifying where buyers and sellers will eventually meet based on their respective incentives and constraints.

Why Philippe Gijsels Thinks $100 is Possible

When a senior strategist at a major European bank like BNP Paribas goes on CNBC and says silver could “potentially double” from already elevated levels, you have to take that seriously even if you ultimately disagree. Gijsels puts his professional reputation on the line with a forecast that, if wrong, will be remembered and potentially damage his credibility.

His thesis centers on silver’s dual nature as both an industrial commodity and a monetary metal, which creates a unique dynamic during periods of elevated uncertainty. Geopolitical tensions, currency instability, trade wars, and technological disruption are all happening simultaneously.

In that environment, investors seek tangible assets with intrinsic value that can’t be devalued by central bank printing presses.

Silver fits that description perfectly while trading at a substantial discount to gold on a historical basis.

The US-China relationship specifically plays a huge role in his thinking. Trade tensions and technology decoupling mean both nations are accelerating efforts to secure strategic commodity supplies and reduce dependence on the other.

Silver falls squarely into that strategic category because of its essential role in electronics, defense applications, and renewable energy.

All sectors where self-sufficiency has become a national security priority. When countries start competing to stockpile critical materials, prices tend to move much faster and further than supply-demand models forecast because you’re adding a strategic premium on top of industrial fundamentals.

Gijsels also points to the psychological aspect of round-number price targets. There’s something about $100 that captures imagination and attention in ways that $87 or $93 simply don’t.

If silver begins approaching that threshold, media coverage intensifies, retail investors who’ve been sitting on the sidelines suddenly feel compelled to join, and momentum builds on itself.

We saw this dynamic with oil at $100, gold at $2000, and Bitcoin at various psychological levels. Markets are made by humans with all their behavioral quirks, and round numbers matter more than rational analysis suggests they should.

The Longforecast Outlier Projection

Among published forecasts, Longforecast stands out for projecting silver above $100 by mid-2026, reaching as high as $108 by year-end. This deserves scrutiny because it’s so far outside the consensus range.

Their methodology appears to rely heavily on technical analysis and historical price patterns rather than basic supply-demand modeling, which introduces both strengths and weaknesses.

Technical analysis can capture momentum and sentiment shifts that basic models miss entirely. If enough market participants believe silver is going to $100 and position their portfolios accordingly, that collective belief can become self-fulfilling regardless of what mine production or industrial demand statistics suggest.

Markets don’t always trade on fundamentals, especially during momentum-driven rallies when FOMO overtakes rational valuation.

Technical projections also tend to extrapolate recent trends further than they’ll actually extend. After a near-doubling in price, pattern-based models naturally suggest continuation because that’s what the historical data shows.

But markets don’t move in straight lines indefinitely.

They experience corrections, consolidations, and sometimes violent reversals that technical models struggle to anticipate.

The Longforecast projection of touching $102 in July before settling back to slightly lower levels by December actually thanks this reality, suggesting even their bullish model expects some volatility and mean reversion. What makes their forecast interesting means we’ll be able to assess whether technical momentum models proved more accurate than institutional basic analysis if silver does make a run toward $100 during 2026.

That would tell us something valuable about the current market structure and which analytical frameworks work best during commodity super-cycles.

The Case for Supply Constraints

You can’t understand where silver prices are headed without really digging into the supply side, which is far more constrained than most people realize. Unlike gold, which gets mined primarily for itself with dedicated gold mines, about 70% of silver comes as a byproduct of mining other metals like copper, zinc, and lead.

This creates a weird dynamic where silver supply can’t respond quickly to higher silver prices because the economics of the primary metal being mined decides whether the mine operates or expands.

Think about what that means practically. If silver hits $100 but copper prices are depressed, miners aren’t going to dramatically increase production of copper-dominant ore just to capture more byproduct silver.

The project economics don’t work that way.

Conversely, if copper demand stays strong and copper prices rise, we’ll get more silver supply even if silver prices are falling. This disconnect between price signals and supply response makes silver particularly prone to sustained deficits when industrial demand is elevated, because the normal market mechanism of “high prices bring more supply” functions imperfectly.

Primary silver mines do exist and could theoretically expand, but developing new mines takes 7-10 years on average from discovery through permitting and construction. That means whatever supply response we might see to current elevated prices won’t materialize until the early 2030s at the earliest.

In the meantime, we’re dealing with existing mine capacity plus whatever recycling the market can generate.

Recycling rates for silver are surprisingly low compared to gold because so much silver gets used in small quantities dispersed across millions of products where recovery isn’t economically viable.

The five consecutive years of structural deficits we’ve experienced didn’t happen by accident. They reflect this basic mismatch between how quickly demand can grow versus how constrained supply response is.

Solar panel installations can double in three years.

Silver mine capacity cannot. Electric vehicle production can scale up rapidly once battery technology matures.

The copper-zinc mines that produce byproduct silver cannot pivot nearly as quickly.

This asymmetry creates the conditions where prices have to rise substantially to bring demand and supply back into balance, and we may not be anywhere near that equilibrium price yet.

Industrial Demand is the Real Story

When I started following silver seriously years ago, the narrative was primarily about silver as money, as a poor man’s gold, as an inflation hedge. Those themes still matter, but they’ve been completely overshadowed by the industrial demand story, which is honestly much more compelling and durable.

Investment demand can evaporate overnight when sentiment shifts.

We’ve seen that repeatedly in precious metals markets. Industrial demand based on technological necessity doesn’t disappear.

It grows steadily year after year because the applications become embedded in infrastructure and consumer products that define modern life.

Solar panels represent the most dramatic component of industrial silver demand growth. Each panel needs roughly 20 grams of silver for the conductive paste that enables energy conversion, and there’s no commercially viable substitute at current silver prices.

The global solar installation pipeline is staggering.

International Energy Agency projections suggest solar capacity needs to triple by 2030 to meet climate commitments, which translates directly into hundreds of millions of extra ounces of silver demand that didn’t exist five years ago and won’t go away even if silver prices rise substantially.

Electronics manufacturing consumes another massive chunk of silver supply across countless applications. Smartphones, computers, automotive electronics, medical devices, appliances.

Every year these products become more sophisticated with more electronic components, steadily increasing silver intensity per unit.

The 5G buildout alone needs significant silver in base stations and network infrastructure, and that’s just beginning. When you layer in emerging technologies like quantum computing, advanced sensors, and next-generation battery chemistries, the industrial demand trajectory points in only one direction for the foreseeable future.

What really makes this demand profile different from previous commodity booms is the political commitment behind it. Governments worldwide have passed legislation and allocated trillions in subsidies specifically to speed up renewable energy adoption and technological advancement.

That’s not market-driven demand that will collapse during a recession.

Policy-driven demand has multi-decade time horizons and budget backing. Even if we hit an economic downturn, those solar panel installations and infrastructure upgrades will continue because they’re already budgeted and politically essential.

That provides a demand floor that silver hasn’t historically enjoyed.

Why Most Analysts Stop at $50-65

The institutional consensus clustering around $50-65 targets deserves respect because these analysts have access to proprietary data and sophisticated modeling that person investors don’t. When Bank of America forecasts $65 as their upper bound, they’re essentially saying “we’ve run the numbers, stress-tested various scenarios, and can’t build a credible case for prices sustainably above this level based on what we now know.” That doesn’t mean they’re right, but it does mean they’ve thought carefully about it.

Their skepticism toward $100 stems partly from mean reversion concerns. Silver has already rallied nearly 100% year-to-date, which is an enormous move by any standard.

Historically, when commodities post gains of that magnitude in a short timeframe, they tend to consolidate or fix before building momentum for another leg higher.

Expecting another 65% gain from current levels to reach $100 would be asking for a roughly 230% total gain from the starting point. Moves of that scale typically need truly extraordinary circumstances like war, currency collapse, or supply shocks beyond what’s now visible.

There’s also the question of demand elasticity at higher prices. While solar panel manufacturers can’t eliminate silver entirely, they can potentially reduce silver content per panel through improved paste formulations and thinner applications.

At $30 silver, there’s little incentive to invest heavily in silver-reduction technology.

At $100 silver, that calculus changes dramatically and research budgets get allocated toward finding ways to use less. Similarly, some marginal electronics applications might accept performance trade-offs if silver becomes prohibitively expensive.

These demand adjustments don’t happen instantly, but they do happen, and they create natural resistance levels where price gains become increasingly difficult.

The institutional analysts are also considering the broader portfolio context. If they recommend heavy silver allocation to clients based on $100 forecasts and the metal instead tops out at $70, those clients suffer opportunity cost from overallocation to a position that didn’t deliver promised returns.

Conservative forecasting protects reputation and client relationships even if it means occasionally missing the biggest moves.

That’s a rational career strategy for someone at a major bank even if it’s frustrating for aggressive investors looking for most upside.

Understanding the Gold-Silver Ratio

The relationship between gold and silver prices, expressed as how many ounces of silver equal one ounce of gold, provides important context for evaluating whether $100 silver is reasonable or absurd. Historically this ratio has averaged around 60:1, meaning gold typically trades at 60 times the price of silver.

During periods of financial stress, the ratio often widens as gold captures safe-haven flows while silver’s industrial components make it more economically sensitive.

During commodity booms and recovery phases, the ratio tends to compress as silver outperforms.

We recently saw this ratio reach extremes above 80:1 during the March 2020 COVID panic, when gold held relatively firm while silver collapsed alongside broader commodities. The subsequent compression back toward historical averages represented a massive opportunity for those positioned correctly.

Currently with silver around $60 and gold near $3,000, we’re looking at roughly a 50:1 ratio, which is actually below historical averages and suggests silver has room to run relative to gold even without making any assumptions about gold’s direction.

If gold maintains its current price around $3,000 and silver reaches $100, that would represent a 30:1 ratio, well below historical norms and into territory we’ve only seen during the extreme silver bubbles of 1980 and briefly in 2011. Could we reach that ratio again?

Absolutely.

We’ve seen it before. But sustaining it would need either unprecedented industrial demand or a speculative mania component that pushes silver temporarily beyond basic justification.

Neither scenario is impossible, but both need conditions beyond what most analysts now forecast.

Alternatively, if silver is going to reach $100 sustainably rather than just touching it briefly during a spike, we probably need gold to rise significantly as well, maintaining a more normal ratio. Gold at $3,500-4,000 with silver at $100 would represent a 35:1 to 40:1 ratio that’s stretched but not unprecedented. This suggests the $100 silver thesis may actually depend more on continued gold strength than most silver bulls think.

Silver amplifies gold’s movements with its typical leverage characteristics.

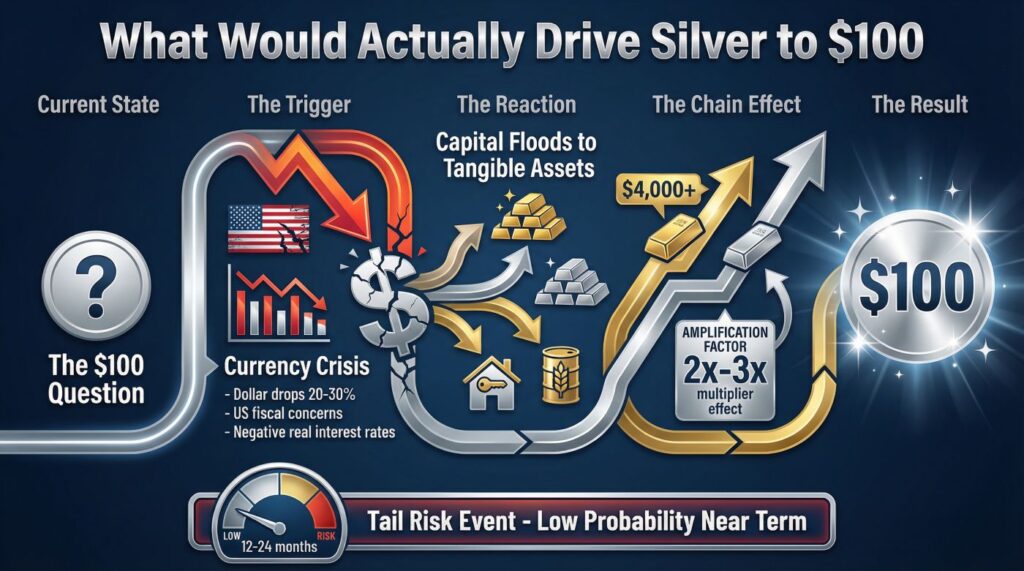

What Would Actually Drive Silver to $100

Let’s get specific about what would need to happen for silver to reach triple-digit prices. Based on historical patterns and current market structure, here are the most likely scenarios that could deliver that outcome.

A substantial currency crisis where the dollar loses significant value rapidly would probably do it. If markets begin seriously questioning US fiscal sustainability and the dollar drops 20-30% against a broad basket of currencies while real interest rates turn deeply negative, capital would flood into tangible assets including precious metals.

In that environment, silver would likely follow gold higher with its typical amplification factor, potentially reaching $100 if gold pushes toward $4,000 or beyond.

This is a legitimate tail risk that serious analysts talk about, though most assign relatively low probability to it happening in the next 12-24 months.

A genuine supply shock from major producing regions would change the equation dramatically. If geopolitical events disrupted silver production from Mexico (the world’s largest producer) or Peru (second largest), or if environmental disasters or regulatory changes shut down multiple major mines simultaneously, the supply deficit would intensify rapidly.

Unlike oil where strategic petroleum reserves can buffer supply disruptions, there aren’t comparable silver stockpiles governments can release to stabilize markets.

Prices would have to rise until demand destruction occurred or choice supplies materialized, and $100 might be what’s required to balance the market under those conditions.

A speculative mania component where retail investors pile into silver en masse believing they’ve identified a generational opportunity could drive prices higher. We’ve seen glimpses of this during the Reddit WallStreetBets silver enthusiasm periods, but those faded quickly.

If that sentiment persisted and built on itself with social media amplification and FOMO dynamics, silver could experience a blow-off top move disconnected from fundamentals that briefly touches or exceeds $100 before correcting sharply.

This would be a trading opportunity rather than an investment thesis, and timing it correctly would be incredibly difficult, but it’s definitely a plausible path to triple-digit prices.

A policy shift where governments begin including silver in strategic reserves alongside traditional reserve assets would completely change the market. If China or India announced significant silver accumulation programs for national security reasons related to technology independence and renewable energy buildout, that demand would come on top of existing industrial and investment flows.

Markets would have to reprice silver immediately to reflect that new structural demand source, and $100 might be the clearing price that balances government buying against industrial users and investors all competing for limited supply.

My Assessment of Probability

After analyzing the forecasts, market structure, and various scenarios, I’d put the odds of silver reaching $100 during 2026 at roughly 25-30%. High enough to be seriously considered but low enough that it shouldn’t be your base case expectation.

That means if you’re positioning for this outcome, you should size your exposure appropriately for something that has maybe a one-in-four chance of occurring rather than betting the farm on it.

The upside case is compelling. We have genuine structural deficits, accelerating industrial demand, supportive monetary policy, geopolitical uncertainty, and momentum that’s already carried prices far beyond where most analysts thought possible six months ago.

The technical setup looks constructive, sentiment hasn’t reached euphoric extremes yet, and positioning data suggests room for more capital to enter the space.

All of these factors align to support significantly higher prices, and under the right circumstances that could mean $100.

The downside risks are equally real. We’ve already seen explosive gains that could naturally lead to profit-taking and consolidation.

Economic data could deteriorate enough to offset investment demand with collapsing industrial consumption.

Technical resistance in the $70-80 range could prove stronger than bulls anticipate. Substitution and demand destruction could kick in faster than historical patterns suggest.

Any of these developments would likely keep silver below $100 through year-end.

What I find most interesting is that this situation isn’t clear-cut where one side is obviously wrong. Both the institutional consensus around $50-65 and the outlier bulls calling for $100 have legitimate supporting arguments.

That tells me we’re in a genuinely uncertain environment where the outcome will depend on variables that haven’t fully played out yet.

The path of monetary policy, the severity or absence of recession, the trajectory of geopolitical tensions, and the behavior of major market participants will all matter. Positioning for that uncertainty rather than betting on one specific outcome is probably the smartest approach.

Frequently Asked Questions

What is the current silver price forecast for 2026?

Most major financial institutions including Bank of America, UBS, and Goldman Sachs have forecasts ranging from $50 to $65 per ounce for 2026. Some outlier predictions from analysts like Philippe Gijsels at BNP Paribas and forecasting services like Longforecast suggest silver could reach $100 or higher, though these represent minority views rather than consensus expectations.

Why is silver demand increasing so much?

Solar panel manufacturing has become the largest driver of new industrial silver demand, consuming about 140 million ounces in 2023 with projections to double within five years. Electronics manufacturing, 5G infrastructure buildout, electric vehicle components, and medical applications are also increasing silver requirements.

These applications are backed by government mandates and trillion-dollar infrastructure commitments, creating policy-driven demand rather than purely market-driven cycles.

Can silver mining production increase to meet demand?

Not quickly. Roughly 70% of silver comes as a byproduct of copper, lead, and zinc mining, meaning silver supply responds to those metals’ economics rather than silver prices alone.

Developing new primary silver mines takes 7-10 years from discovery through permitting and construction, so any supply response to today’s elevated prices won’t materialize until the early 2030s.

This creates structural supply constraints that high prices alone cannot quickly resolve.

Is silver a better investment than gold right now?

Silver offers higher volatility and potential returns and higher risk compared to gold. The current gold-to-silver ratio around 50:1 is below historical averages, suggesting silver may have more room to appreciate relative to gold.

Silver’s industrial demand component provides basic support and makes it more economically sensitive during recessions.

Your choice depends on risk tolerance and whether you want the relative stability of gold or the amplified moves that silver typically provides.

What happens to silver prices during a recession?

Silver’s behavior during recessions varies depending on the policy response. During the 2008-2009 financial crisis, silver initially crashed from around $20 to $9 as industrial demand collapsed. During the 2020 COVID recession, silver bottomed quickly and rallied hard because massive monetary and fiscal stimulus shifted concerns from deflation to inflation.

The key variable is whether the recession creates deflationary pressure or whether policy responses are inflationary enough to drive safe-haven demand into precious metals.

How much silver should I hold in my investment portfolio?

Most financial advisors suggest 5-10% combined allocation to precious metals for diversified portfolios, with silver representing a subset of that depending on your risk tolerance. Silver’s high volatility means position sizing matters enormously.

If a 20% pullback in your silver holdings would cause genuine stress or force you to sell at the worst time, you’re sized too large regardless of how bullish you feel about long-term prospects.

The possibility of silver reaching $100 is real enough to warrant consideration but uncertain enough that making it your central investment thesis would be imprudent. The structural factors supporting higher silver prices are legitimate and likely to continue, but the path from $60 to $100 needs sustained momentum through multiple resistance levels while avoiding recession-driven demand destruction.

The institutional consensus around $50-65 represents the most probable outcome based on current information, while $100 represents a bullish scenario that needs favorable conditions across multiple variables aligning. Outlier predictions may ultimately prove more fix than the major banks, but assigning high confidence to that outcome now would be premature.

How you position for this environment matters more than precisely predicting the ultimate price. Appropriate sizing, diversification across implementation vehicles, predetermined entry and exit rules, and emotional discipline will decide whether you actually benefit from silver’s potential run regardless of whether it stops at $65 or reaches $100.